You’ve found mold in your home. It’s time to call in a professional to get the mold out as quickly as possible – and to find the source of the issue and stop it in its tracks before it can spread further. Depending on how severe the mold infestation is, a mold specialist and restoration work can be costly.

Is mold covered under your homeowners insurance? Let’s take a look at the typical coverage for mold damage.

Insurance Coverage for Mold Damage

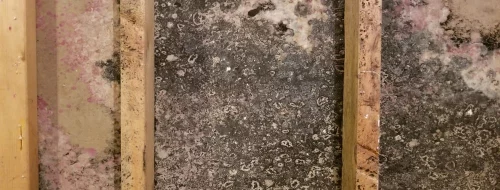

Mold is a fungus that grows quickly in high humidity areas. It needs three things to grow – an organic surface, a damp area, and warm temperatures. An attic is primary real estate for mold growth, which is why you may find patches of mold growing all over the highest level of your home.

If you see mold spores in your attic – don’t ignore them. If left untreated, mold will not only lead to health issues for those in the household, but can also cause damage to the host material – in this case, the beams in your attic.

Typically, mold is discovered under two circumstances.

- You’ve noticed moisture build-up in your attic – usually through a slow leak that has gone unnoticed for a while.

- A flood or other major water damage has occurred, and despite best efforts, mold has taken hold in your attic.

Insurance claims for mold fall under “first party” property claims, and require an insurance agent to investigate the claim and decide if the issue is covered under your policy or not.

Types of Coverage

Commercial, homeowner, and renter property insurance policies are all different based on the insurance company. If mold is covered under the policy will depend on the language of the policy itself. This is why it’s extremely important to read your policy carefully. Be sure to ask questions of your underwriter if you are unsure of the verbiage.

- Specified Peril policies cover mold damage if the mold is caused by any listed “peril” or causes. These will be listed individually in your policy.

- All Risk policies are just that – policies that cover basically everything. Mold may be covered in this type of policy, unless the insurance company can prove there is an exclusion.

An important note – property policies typically have a long list of exclusions for damage caused by mold. Always verify with your insurance company and explicitly ask when your policy is written out if mold is covered.

When is Mold Covered?

Typically, mold damage is covered by your insurance when it develops a problem from water damage – which is covered under your policy. The biggest fight is proving to the insurance company that the cause of the mold actually came from the water damage, and not a pre-existing problem.

At McMahon Services, our mold remediation team is skilled in working with insurance companies and providing them with all the documentation and information necessary to process a claim. We will handle the mold remediation and restoration process from start to finish, working with you to find the source of the mold, and stopping it in its tracks.

We will then begin our clean up process, and if necessary, work with your insurance company. Our experts are standing by ready to help in all water damage and mold cases – even when emergency issues arise. Call us 24/7 – and see how we can help.

0 Comments